The Financial Freedom Flywheel

A flywheel respresents a series of steps in cyclic fashion that feed each other. The financial freedom flywheel consists of EARN, SAVE & INVEST. As you earn more money, you are able to save more and hence invest more. Over time, these investments feed your earnings and the cycle repeats itself. As time passes, and the flywheel turns more and more, it gathers momentum and reaches a point where you do not need to spend time earning because your investments are aleady earning enough. This is the point at which you reach Financial Freedom.

The three parts of the flywheel are each driven by one key aspect. For earning, the key aspect is SKILL. The more you can improve your skills and the better you are at what you do, the more you will earn. For saving, the key is LIFESTYLE. The more you can lower your lifestyle, and live below your means, the more you can save. For investing, the key is DISCIPLINE. Wealth is built not by ad-hoc or random decisions, but over years of planned and disciplined investing.

Watch related video

The Savings Rate Theory

Savings Rate Theory states that your savings rate alone can determine how quickly you can achieve financial freedom and retire. Savings rate is the % of after-tax income that you save every year. It may seem suprising that just one number can determine your time to retire, but this is backed by math. The table above shows the savings rate and corresponding number of years it is likely to take to retire. So for example, if you save 50% of your income, you can retire in about 19 years.

The reason this works is that your savings rate determines how your lifestyle is related to your income. Think about the implications of this theory! For exmaple, let's say that eating out at expensive restaurants is costing you 10% of your income every month. This poses a question: if saving 10% more can free up 8-10 years of your life, what is more important to you, 10 years of your life or eating out at expensive places?

You should be aware that there are assumptions in this table on the inflation rate and other factors. Those assumptions will only change the specific numbers, but they don't change the theory that your time to retire is largely determined by your savings rate.

Watch related video

The Financial Freedom Pyramid

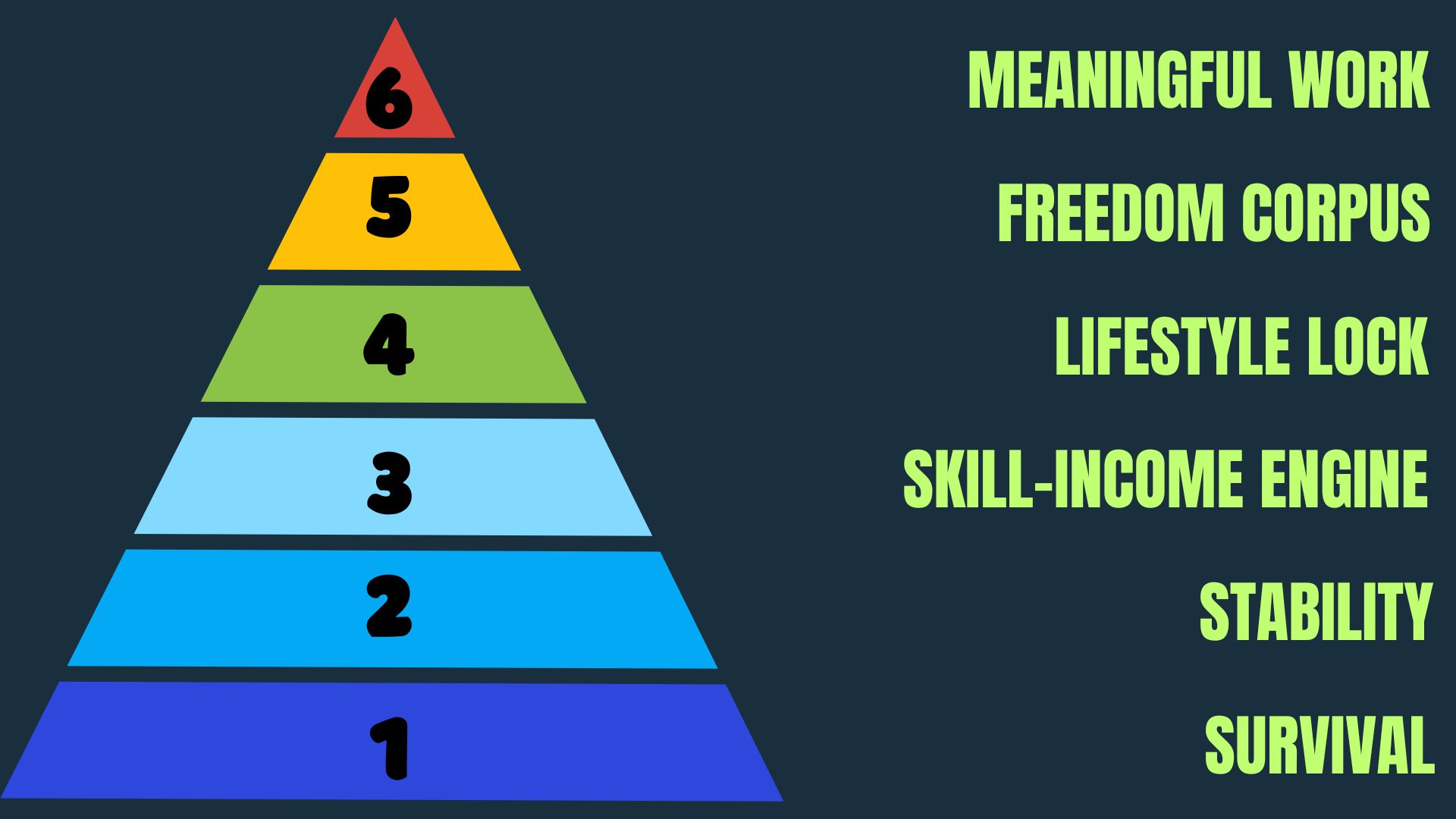

The Financial Freedom Pyramid divides the journey to financial freedom into a set of steps represented as a pyramid.

Survival (1): You start by first calculating the specific number that you need for mere survival which are things like rent, grocery, basic transport, etc.

Stability (2): You then build a fund that has 18 months of survival expenses which essentially means you have 18 months of freedom and don't need to worry about the short term.

Skill-Income Engine (3): This is your earning machine. Not your job title – but your actual marketable skill, anything that pays you for value. The key is to build a skill that lets you earn more working fewer hours over time. This is how you increase income without increasing stress.

Lifestyle Lock (4): Freeze your lifestyle. Avoid upgrades. Same house, same car, same phone – even when you’re earning 10x. This gap between earnings and spending is what you invest. This is your freedom gap.

Freedom Corups (5): This is the magic number. The amount you need to generate passive income for life. You should calculate this number and then work towards building this corpus.

Meaningful Work (6): Retirement isn’t about not working. It’s about not being forced to work. Once you're free, you can write, teach, create, mentor, build, travel – without worrying about money.